Important

Desert Financial will never ask for your username, password or verification code in a text, email or phone call.

When in doubt, hang up the phone and call us at (602) 433-7000.

How to detect scams and prevent fraud

Protect your finances and information from fraudsters.

Learn moreDouble-check that text

If Desert Financial ever texts you a multi-factor authentication code, it’s important you don’t share it with anyone. Fraudsters could use it to try to access your accounts.

The Federal Trade Commission has reported a recent surge in fraud from phishing.

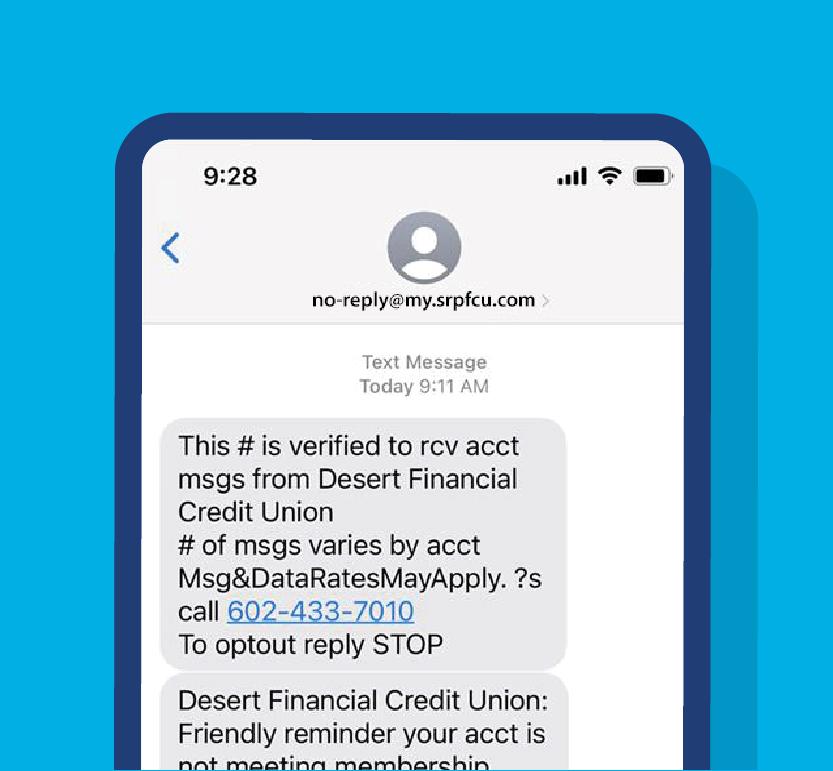

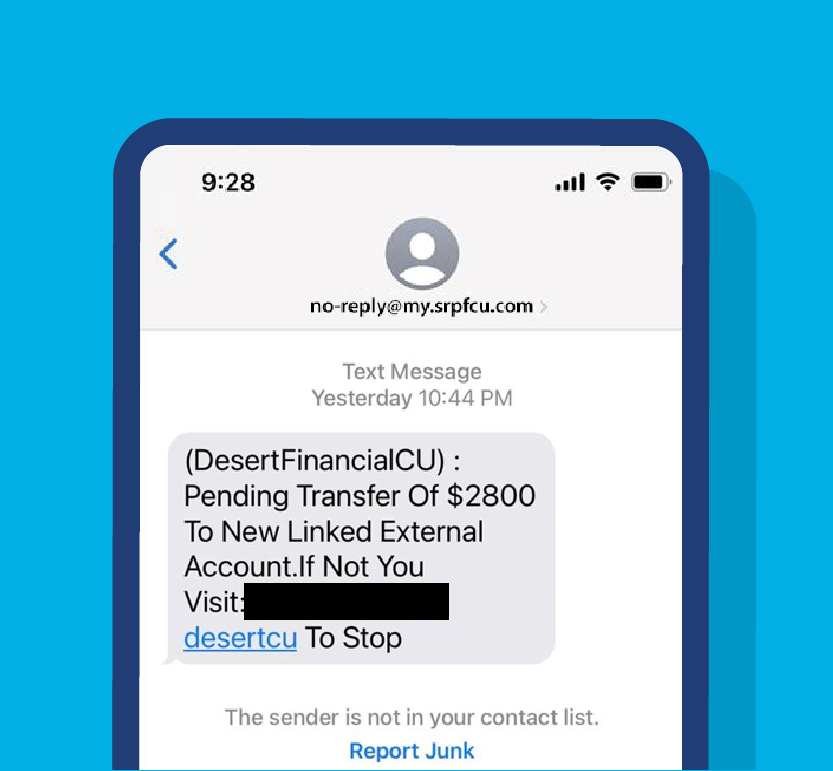

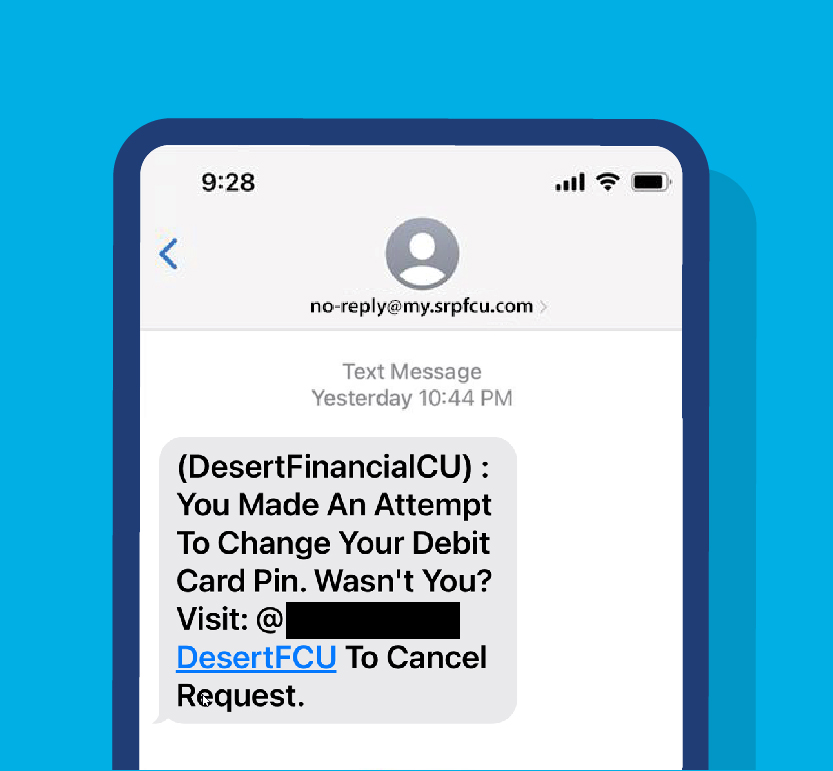

Phishing occurs when a scammer calls you or sends you a text or an email that looks like it’s from a legitimate source, asking you to click on a link, download an attachment or provide sensitive information. Here are examples of phishing texts that look like they are from us. These are scams and were not sent by Desert Financial.

Types of scams to look out for

What can you do to protect your online identity?

While you may be able to get your money back in the event of fraudulent transactions on your account, many financial institutions will not reimburse the transactions if you knowingly give your financial information to a scammer.

- Visit our site directly or use our mobile app. Be wary of suspicious links or emails.

- Create unique digital passwords for important sites and do not enter them into unknown sites.

- Enable mandatory multifactor authentication on important accounts using one-time numeric PIN codes. Protect these codes and do not provide them to anyone.

- Enable automatic software updates and security patches on all devices including cable modems and home Wi-Fi routers.

Fraud FAQs

How can I protect myself from becoming a victim of fraud or identity theft?

- Use strong, unique passwords for each of your accounts.

- Enable two-factor authentication where possible.

- Be cautious of unsolicited emails, calls or text messages asking for personal information.

- Regularly monitor your bank and credit card statements for unauthorized transactions.

- Shred documents containing personal information before disposing of them.

As a reminder, Desert Financial will never call you and ask for your account credentials. Do NOT give account credentials to anyone.

What steps should I take if I receive a phishing email or message about my Desert Financial account?

- Do not click on any links or download attachments.

- Do not respond to the message.

- Report the phishing attempt to us by calling (602) 433-7000.

- Send a copy to us at emailfraud@desertfinancial.com.

What should I do if I've become a victim of fraud or identity theft?

- Report it to local law enforcement.

- Identity theft victims should also:

- Add a fraud alert to your Experian Credit Report: Experian Fraud Alerts

- Add a fraud alert to your TransUnion Credit Report: TransUnion Fraud Alerts

- Add a fraud alert to your Equifax Credit Report: Equifax Credit Fraud Alerts

- Fraud victims should also:

- Report a cybercrime crime by filing a complaint to the FBI IC3

- Report to the FTC: FTC Report Fraud

- Additionally, to report unwanted calls, texts, spoofing, you can report to the FCC: