Home

Home equity loan, HELOC or refi?

In this article

- Why tap into your home’s equity: Home equity can be used for needs such as bills, home improvements and expenses.

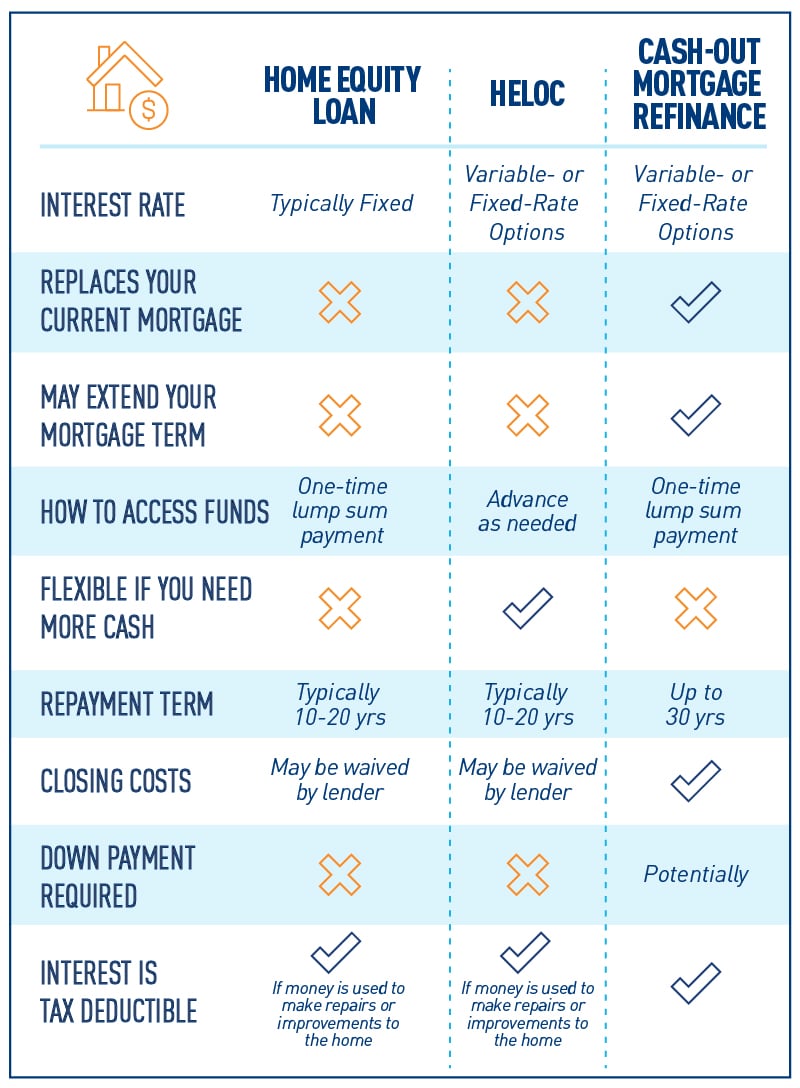

- What to consider: There are three ways to tap into your home's equity: home equity loan, HELOC and a cash-out refinance. Each option offers unique benefits and factors.

- Decide on the right choice: Pick the option aligned with your financial goals. Compare costs, terms and benefits to make an informed choice.

If you’re looking for ways to get cash for bills, home renovations or other expenses, your home equity could provide a solution. There’s more than one way to tap into your equity, though. We’re breaking down the pros and cons of a home equity loan vs. a HELOC vs. refinancing with cash out.

Home values in Arizona have increased in the past few years, causing many homeowners to consider borrowing against their home’s equity. What is equity? The difference between the value of your home and the amount you still owe on your mortgage.

For example, if your home is currently valued at $450,000 based on a home appraisal and you have a $175,000 balance remaining on your mortgage, you would have approximately $185,000 in equity. You may be able to borrow against your equity if you need funds for repairs, remodeling, bills or other expenses. While lenders won’t typically loan you the full value of your home’s equity, they may loan up to 80% of it on average.

Here are three ways that you can tap into your home’s equity to get cash:

- With a home equity loan

- With a HELOC (Home Equity Line of Credit)

- By refinancing your mortgage with a cash-out option

Typically, the lender will arrange for a home appraisal to value your home with any of these options.

Home equity loan: The steady choice

A home equity loan uses the equity in your home as collateral. Typically, the lender will arrange for a home appraisal to value your home. With a home equity loan, you would borrow a set amount at a fixed interest rate and pay it back in equal monthly installments – much like you do with an auto loan.

Some of the main benefits of a home equity loan are:

- Your interest rate will not fluctuate, due to the fixed rate

- You know exactly how much you’ll pay each month

- An upfront payment to you of the entire loan amount

HELOC: Flexibility & options

A HELOC, or home equity line of credit, also borrows against the equity you have in your home. HELOCs typically have variable rates, which means your interest rate will fluctuate up and down with the market.

Here's how a HELOC works:

- After being approved for a HELOC, the approved amount acts like your credit limit on a credit card.

- You may choose to withdraw some or all of your HELOC funds as you need them.

- Withdrawals, also known as advancements, are able to be taken during your draw period (typically, 5 to 10 years).

Example: Let’s imagine that you are approved for a $35,000 HELOC. You withdraw $5,000 from your HELOC to pay some urgent bills. Five months later, you withdraw $10,000 to pay for a bathroom remodel. At this point, you have used a total of $15,000 of your HELOC funds, leaving $20,000 still available.

Your monthly payment on a HELOC is based on your total outstanding balance, whether the amount used was taken as a one lump sum or as multiple advancements.

Some lenders, such as Desert Financial, offer a hybrid HELOC with the option of a fixed rate on certain withdrawals. This type of loan allows you the flexibility of a traditional HELOC while still offering the peace of mind of a set interest rate.

To sum up, benefits of a HELOC include:

- It’s flexible and easy to use

- You can withdraw funds only as you need them

- There’s a fixed-rate option available to help you plan your payments

This type of loan works well for situations where you may need the money in smaller increments over time — for example, if you’re planning to complete several remodeling projects in the coming years or if you have multiple goals you want to reach (such as consolidating high-interest debt payments and paying for home repairs).

Refinancing: One loan for everything

The third option for tapping into your home equity is refinancing your mortgage with a cash-out option. In this scenario, you are replacing your current home loan with a new home loan for a larger amount than what you currently owe in order to access funds from your available equity.

Let’s return to our $450,000 home value example, where your current mortgage balance is $175,000. You work with your lender to get $50,000 cash out with a mortgage refinance. So, your new mortgage amount would be $225,000 — your existing $175,000 balance plus the additional $50,000 cash you are borrowing from the equity in your home.

Your new mortgage may have a fixed or variable interest rate depending on the type of loan. The upside of a fixed rate is that your payment amount will be the same every month, making it easy to plan for. However, if interest rates go down, you wouldn’t automatically get the lower rate. With a variable rate, you’ll be able to take advantage of low points in the market; however, you would also have your rate rise with increases in the market.

How each loan stacks up

Now that you understand the basics of each loan type, let’s look at how a home equity loan, HELOC and cash-out refi stack up when it comes to costs and benefits. Keep in mind that not every lender offers all three loan types, and each lender will have different terms and options available for tapping into your home’s equity. Check with your credit union or mortgage lender for specifics on home equity options.

Bringing it home

Ultimately, when it comes to accessing the available equity in your home there are pros and cons to each loan option. A standard fixed-rate home equity loan might be ideal for a one-time need while rates are low, while a cash-out refinance works best if you want to stick with a single loan payment. A home equity line of credit with a fixed-rate option from Desert Financial offers both flexibility and peace of mind, especially if benefits like a low introductory rate and the ability to borrow money as you need it are important to you. Get in touch with us to talk about your options for home equity and mortgage refinancing!

Related content

Subscribe to our blog

Fill out the form below to sign up for our blog.