Financial Education

Get down with the digital wallet: How to use it and why

In this article

- Digital wallet basics: A digital wallet is like a virtual version of your physical wallet, allowing you to make electronic payments through apps

- Embrace contactless convenience: Tap-and-go payment methods make quick purchases by holding your smartphone near a terminal.

- Enjoy security and safety: Digital wallets provide secure transactions through encryption and tokenization.

Technology can be intimidating — like contactless payments, which are also commonly referred to as touchless/mobile payments and mobile/digital wallets. Think of these as tap-and-go payment methods that allow you to make quick in-and-out purchases by just holding your smartphone near the terminal. It’s not as complicated as you may think!

The benefits are evident, including a simple setup and faster, easier and more secure transactions. In fact, contactless payments are used far more often globally, and Americans are increasingly starting to catch on.

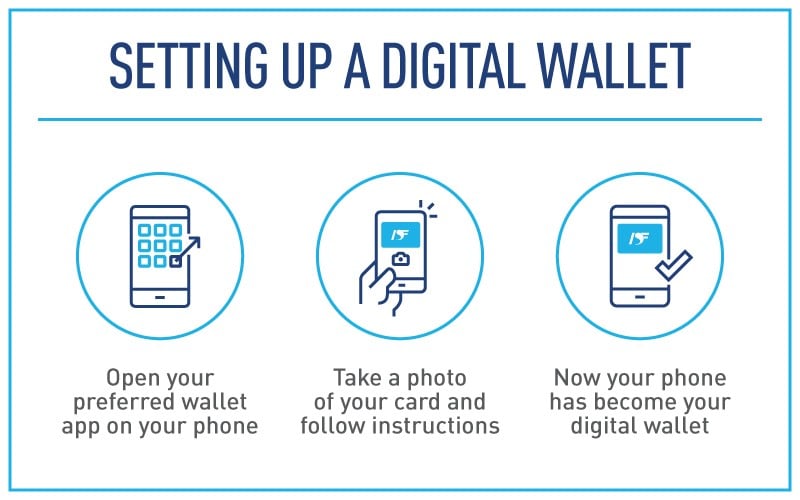

Ready to get down with the digital wallet? Keep reading to learn more about digital wallets, including how to set yours up. After a few practice runs, you’ll confidently be able to make touchless payments and zoom through the checkout like a mobile payment pro.

What is a digital wallet anyway?

Have you ever stood behind someone in line at the store and watch them wave their phone in front of the register’s reader? The customer is using their digital wallet: Think of a digital wallet as an app on your smartphone (or other electronic device) where you store your payment information. You use your digital wallet to purchase something online and in stores, without having to fumble over your physical wallet and credit or debit card. A digital wallet can also hold gift cards, coupons, loyalty cards, tickets and boarding passes. The most popular contactless apps are Apple Pay, Google Pay, Cash App and Samsung Pay. Not all retailers accept mobile payment, so look for a contactless payment sign on the reader indicating that the service is accepted.

Some people may also call social and peer-to-peer apps (like Venmo, PayPal and the Zelle app) digital wallets too. These mobile payment apps allow you to send payments to people and retailers, for instance, to split the cost of dinner among friends or pay a merchant, respectively.

Why use a digital wallet?

If you haven’t yet joined the digital wallet revolution, check out these projections from a recent Juniper Research study:1

- Tap-to-pay transactions are projected to reach $10 trillion globally by 2027.

- Mobile and wearable contactless payments are anticipated to grow by 221% in the next five years.

Numbers don’t lie. A fast-rising number of people (and businesses) are going digital and here are some reasons why:

- Convenience & speed: Contactless payments make the transaction process speedier. Simply take out your phone, tap to open the app and tilt it over the reader. It’s a smooth transaction and eliminates the somewhat cumbersome steps of paying with a physical card or cash. After a few tries, you’ll breeze through checkout lines without skipping a beat.

- Security: Can a digital wallet be trusted? Yes. Mobile payments are highly secure because of strong encryption and tokenization. By using a digital wallet, you're assigned a unique digital card number that's linked to your payment method and the wallet itself, rather than your actual card number. This means that your card number isn't stored anywhere, making digital wallets more secure than many people realize. Even if someone were able to break through the encryption, the number they'd get isn't even your card number – so it’s extra secure!

- Safety: It’s no wonder contactless payments have recently gained momentum in popularity. It’s another way we can preserve our health by not touching high-traffic surfaces.

Debit, debt & digital wallets

With all the perks and rewards attached with credit cards, debit cards can be considered as a monetary relic reserved for taking out cash. Keep in mind, according to data gathered by Fortunly, “credit cards make people spend more money, sometimes up to 83% more,” (yikes!) and the average credit card debt per person is over $6,000.2 Abusing credit is not only financially stressful, it’s mentally and emotionally stressful as well.

To help money feel more real while using plastic, choose debit over credit for your digital wallet or mobile payment app. You’ll get a better overview of your spending with a quick balance check and eliminate the risk of reaching that average of $6,000 in credit card debt.

Debit card safety & security

As an extra precaution, make sure your digital device is secure through a fingerprint, facial recognition or password verification. Also, keep your phone’s security features up-to-date and check in with your accounts frequently in case of any fraud!

At Desert Financial, your Visa® Debit Card is fraud-protected and we act quickly to resolve qualified fraud claims. To protect your debit card, review your checking account regularly, report fraudulent charges or lost/stolen cards immediately, keep your debit card in your possession at all times, protect your PIN number and only use your debit card with trusted vendors.

Related content

Subscribe to our blog

Fill out the form below to sign up for our blog.

Disclosures

1

https://www.juniperresearch.com/researchstore/fintech-payments/contactless-payments-research-report

2

https://fortunly.com/statistics/cash-versus-credit-card-spending-statistics/#gref